Chegg (CHGG) - maybe we are crazy to bet that AI won't kill this company

This is an idea that is not for the faint of heart!

Investment Thesis: The Call Option with Long Duration

We fundamentally think of Chegg ($CHGG) as a long duration call option on meaningfully FCF generative company with a solid balance sheet. But there is one catch. This might get Chat-GPT’d all the way to zero.

So if that scares you, you should stop reading. But if you like the idea of a potential 3-5x’er in the next 12-24 months and have the stomach for the downside risk, peep below:

We basically think the there are 2 scenarios for CHGG:

Scenario 1 (Zero): AI renders Chegg entirely irrelevant, revenue goes to zero and the stock fades into oblivion. You lose all your money.

Scenario 2 (3-5x Return): Chegg adapts, stabilizes, and uses its cash position and strategic buybacks to unlock significant equity value. The stock rerates from the current 1.5x FCF multiple to something reasonable like 4-5x and we have a multi-bagger on our hands.

So why do we think scenario 2 is even an option? A few reasons:

First, we believe the market is missing Chegg’s balance sheet strength.

More specifically, if you look up CHGG on Bloomberg or Yahoo Finance or your favorite stock screener, you see a market cap of $160M and an EV of $424M. A lot of debt, right?

*Yahoo Finance screenshot above

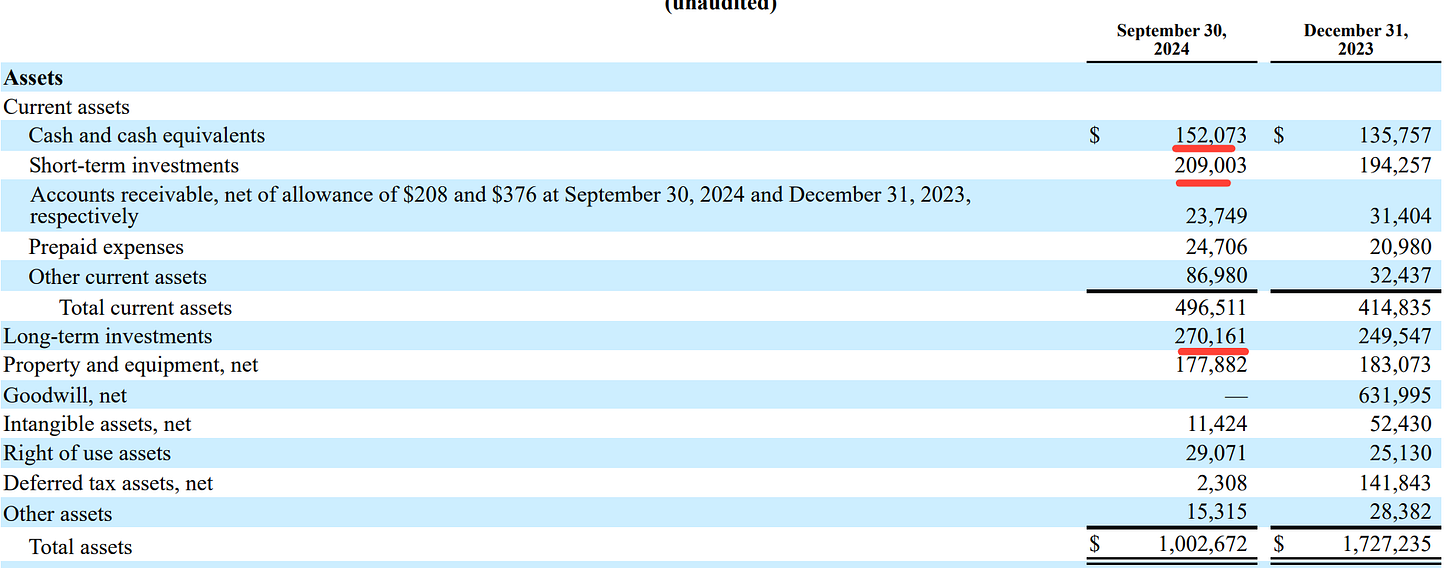

Wrong. Chegg actually has a bunch of short-term and long-term investments that they cannot call cash & cash equivalents on the balance sheet - to be precise $152M of cash, $209M of ST investments and $270M of LT investments as of Q3 2024. But take a look at at these investments are - treasuries, munis, and corp debt. All relatively liquid.

So if we redo the EV math based on this, we get a very different number from the $424M on Yahoo Finance - we actually have at net cash position and EV is $130M based on Q3 2024 cash and debt numbers.

But wait, there is more.

The cash and debt numbers we just showed above are as of September 2024. Since then, CHGG has done a pretty cool thing and paid off some of their debt early at less than face value. Press release screenshot below

Ok, so let’s redo the math - since Chegg paid off $116.6M of debt but only used $96.2M of cash to do so, it created a bunch of value for us! We are now $45M net cash, and our EV is $111M. Boom Shakalaka?

In general, we believe there is meaningful upside here from Chegg’s ability to repurchase its notes at a discount to face value. Every dollar spent buying back debt below face value increases equity value.

And more repurchases are likely, since Chegg still has $207.5M in authorized buybacks, which could be used strategically. If they continue executing on this, equity holders stand to benefit significantly.

Ok, so we’ve convinced you that EV is closer to $100M than $430M.

But what does this earn and what about the issue of being Chat-GPT’d (or Deepseek’d) into oblivion?

Second, we think it’s hard to lose money quickly here

The short answer is…further revenue declines are expected, but given the current FCF generative nature of the business and expense management forecasted, it’s hard to see a downside where FCF is below $30-$60M next year.

Unlike other troubled companies, Chegg isn’t hemorrhaging cash. Here are some flash financials:

So even with revenue declining 14% this year in 2024, Chegg should do $150M in EBITDA and $60M in FCF in 2024.

Next year, if we assume another 15%+ revenue decline year, we get $130M on EBITDA and $55M of FCF. Chegg has also said they are kicking off a large expense reduction program that should yield $100M-$120M in GAAP cost savings in 2025.

Even if revenue declines further, Chegg has room to go. Based on our calculations, for FCF in 2025 to drop to $30M (still covers 1/3 of the EV), revenue in 2025 would have to decline by close to 40%. Possible? Yes. Probable? Probably not.

If you believe $50M in FCF, we’re getting Chegg at 2.2x FCF

If you believe $30M in FCF, we’re getting Chegg at 3.7x FCF

The real bet though, is if Chegg can pivot?

The fundamental case question here isn’t if AI disrupts Chegg, but whether Chegg can evolve fast enough. A few things we are seeing, but early to call:

Chegg GPT & AI Tools: The company is actively shifting toward AI-driven tutoring.

Education-Specific AI Advantage: Chegg owns structured, curriculum-aligned data that generic AI models lack.

Learning from Duolingo: A successful AI-enhanced pivot, similar to Duolingo’s gamification strategy, could restore valuation multiples.

Chegg also offers some things that generative AI products do not today:

Accuracy & Trustworthiness

AI models like ChatGPT can sometimes generate incorrect or misleading answers due to the nature of probabilistic text generation.

Chegg’s human-verified content ensures a level of academic reliability that free AI models can’t inherently guarantee.

However: OpenAI and others are already moving toward fine-tuning AI models with curated, verified sources (e.g., Khan Academy, Wolfram Alpha integrations), reducing this advantage over time.

Curriculum Alignment & Textbook Licensing

Chegg’s solutions are structured to align directly with specific textbooks and university syllabi, which generic AI does not natively do.

However: AI models can quickly generate similar structured learning materials, and universities could license AI-driven alternatives.

Personalized Learning Insights

Chegg has years of student behavioral data, helping it optimize learning paths.

However: AI-powered platforms (like Duolingo or Khan Academy’s AI Tutor) are developing real-time adaptive learning algorithms, closing the gap.

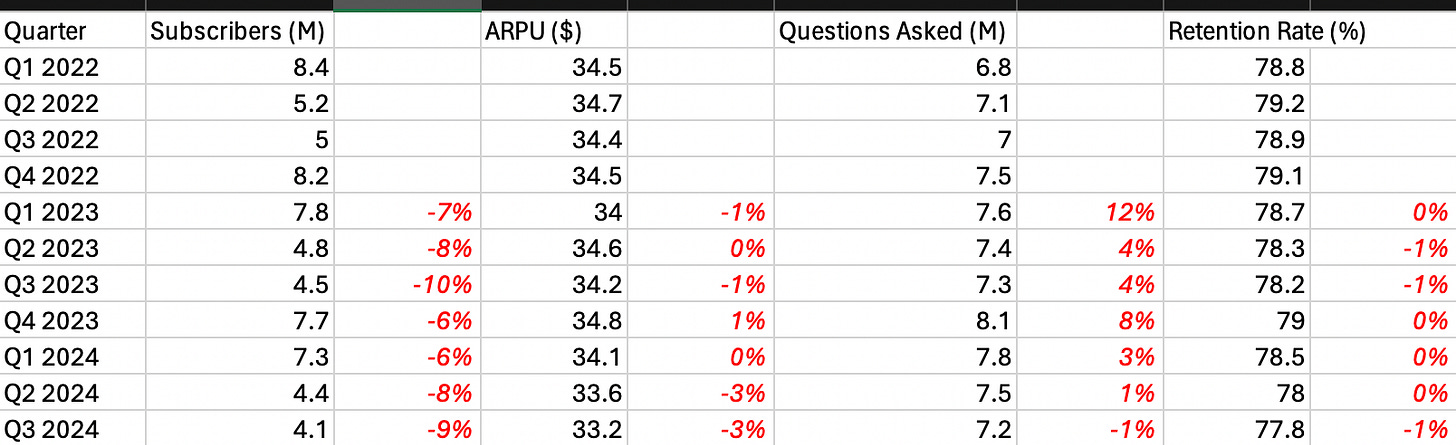

Customer metrics seem to support this - yes we are churning 8-10% a quarter in subs, but the subs that remain are still paying (flat-ish ARPU), and asking more questions and being retained at similar rates. And that’s still 4 million subscribers!

Risks - of course they exist.

Risk: AI makes Chegg obsolete.

Mitigant: AI-native solutions (Chegg GPT) could carve out a niche.

Risk: Cash burn accelerates.

Mitigant: $100M+ in cost reductions buys time.

Risk: Poor execution on buybacks.

Mitigant: Buybacks have already begun at a discount, signaling intent.

Conclusion: If you have high blood pressure or don’t like the possibility of losing money, don’t read this!

But if you like assymetric risk/reward, this is one to monitor closely

At ~$1.40 per share, Chegg is an intriguing, high-upside opportunity, but timing is everything.

The market assumes a zero outcome, but the fundamentals show more resilience.

Balance sheet strength, cash flow cushion, and debt buybacks provide real levers to increase equity value.

If the business stabilizes, the upside is 3-5x from here.

The worst-case scenario isn’t happening overnight; there’s time for a turnaround.

For now, this is a name we want to monitor closely. While the setup looks compelling, the next earnings call should provide more clarity on execution. If the initial turnaround efforts show promise, this could be an excellent entry point. But we’ll wait for signs that the risk is de-escalating before jumping in.

As usual, this is not investment advice and you should do your own diligence.

We are going to monitor this closely and begin nibbling potentially after the next Chegg earnings call.

the problem is...ai is moving so much faster with a new product or tool introduced every week.

in 1908, there was probably some undervalued horse buggy company...but they are surely cheaper now.

Interesting & well written article. As someone who used Chegg during my university studies to help with assignments & homework. I saw their shift to AI firsthand.

It remains to be seen if they can evolve fast enough, but their definitely trying to pivot that way, and I agree they need to if they are going to survive.